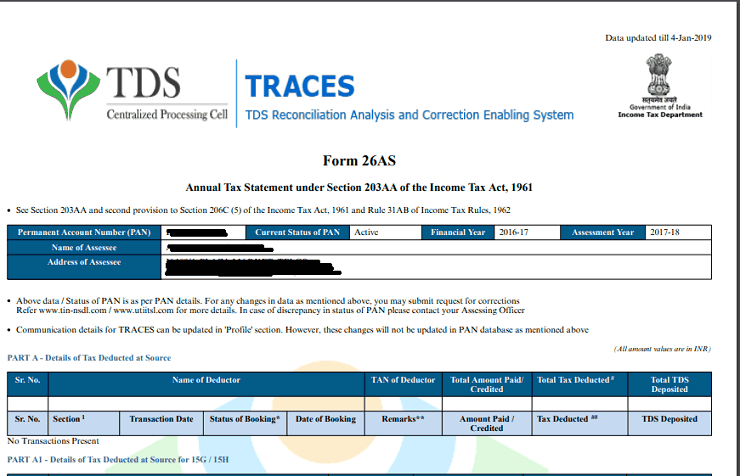

It is an important document that taxpayers should check regularly to ensure that their tax payments are accurately reflected and to avoid any discrepancies or penalties related to taxes. In essence, Form 26AS is a comprehensive statement of all tax-related transactions that have been recorded with respect to a taxpayer's Permanent Account Number (PAN) during a given financial year. One can visit the income tax e-filing website to download form 26AS. It is an important document for verifying the income tax paid by a taxpayer.įorm 26AS is prepared and maintained by the Income Tax Department of India, and it contains details of tax payments made by the taxpayer as well as any tax deducted or collected by third parties on behalf of the taxpayer, such as employers, banks, or other entities utilizing the services of taxpayers.

Income tax form 26AS is an annual consolidated statement that provides a summary of the tax deducted at source (TDS), tax collected at source (TCS), and other details such as advance tax and self-assessment tax paid by a taxpayer for a particular financial year.

0 kommentar(er)

0 kommentar(er)